MaurineTheuri

Member

In my social media escapades, I came across a meme that gave me sleepless nights and pushed me to write this article. ‘Retirement will treat you the way lockdown is’, the meme insinuated. It went on to explain that the key similarities are the lack of an income and lots of time on one’s hand. It implied the Covid-19 pandemic and retirement are different situations cut from the same cloth. It is clear that the pandemic has been rough on all of us – from income disruption, education been almost at a standstill, negative returns on investments, transport heavily affected, sectors crippled to actual health effects, and even death. However, every adversity presents a learning opportunity.

The Gross Savings Rate in Kenya as of December 2019 was a meagre 5.4% according to the Kenya National Bureau of Statistics which only serves to explain the poor savings culture we have in our country. Nigeria and South Africa had savings rates of 20.6% and 14.6% respectively. According to the 2019 FinAccess Household Survey, the top reasons why Kenyans are poor savers are lack of a regular income and low levels of income. While these reasons are in actuality good reasons, we as a nation ought to create and sustain a savings culture despite our level of income. It is important to know that there is no absolute way of saving for future needs- everything is relative as everyone has different incomes, different hobbies, and different obligations such as family, loan, and other commitments. However ratios such as the 50-20-30 rule act as good financial planning guidelines. This rule proposes that despite your income level, 50% of your income should go towards necessities, 30% towards discretionary items and one should save 20%.

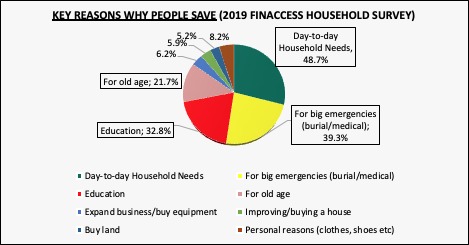

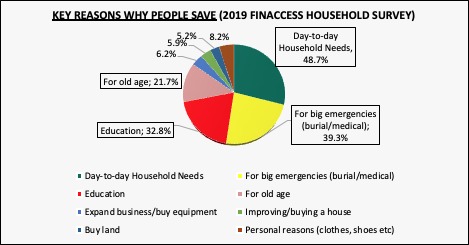

People save for various reasons as illustrated in the pie chart below:

One common reason why people save is for retirement or old age. Retirement savings not only ensure that you live comfortably in retirement but also help you avoid being a burden to your relatives in old age. The aim is to not go through one’s golden years without the gold. However, in Kenya, figures by the Retirement Benefits Authority show only 21% of the working population are part of pension schemes. This leaves at least 12 million people with no sort of retirement or social security fund to rely on when they retire.

Many Kenyans do not understand the importance of retirement planning. Some of the benefits include:

Think of your finances as a tree. The income you earn is the roots and the lifestyle you lead including bills are the rest of the tree above the soil. If you cut the tree but still have the roots then you can slowly regain your lifestyle over time. If your roots increase in size over time then your tree size also increases. However, should you cut the roots no matter how big the tree is, it will wither; if you are lucky enough and have been saving in your productive years, then your retirement benefits will replace the previous income and you may be able to maintain the same living standards without too much hustle.

The Covid-19 should serve as a wakeup call on why we should save and plan in advance. Just remember Covid-19 is temporary and can change but once you retire there is no going back. During this period, there is a great need for flexibility in terms of retirement savings. One can revise down their contributions or temporarily suspend contributions if they no longer have an income during this period

The Gross Savings Rate in Kenya as of December 2019 was a meagre 5.4% according to the Kenya National Bureau of Statistics which only serves to explain the poor savings culture we have in our country. Nigeria and South Africa had savings rates of 20.6% and 14.6% respectively. According to the 2019 FinAccess Household Survey, the top reasons why Kenyans are poor savers are lack of a regular income and low levels of income. While these reasons are in actuality good reasons, we as a nation ought to create and sustain a savings culture despite our level of income. It is important to know that there is no absolute way of saving for future needs- everything is relative as everyone has different incomes, different hobbies, and different obligations such as family, loan, and other commitments. However ratios such as the 50-20-30 rule act as good financial planning guidelines. This rule proposes that despite your income level, 50% of your income should go towards necessities, 30% towards discretionary items and one should save 20%.

People save for various reasons as illustrated in the pie chart below:

One common reason why people save is for retirement or old age. Retirement savings not only ensure that you live comfortably in retirement but also help you avoid being a burden to your relatives in old age. The aim is to not go through one’s golden years without the gold. However, in Kenya, figures by the Retirement Benefits Authority show only 21% of the working population are part of pension schemes. This leaves at least 12 million people with no sort of retirement or social security fund to rely on when they retire.

Many Kenyans do not understand the importance of retirement planning. Some of the benefits include:

- Monthly tax relief of up to Kshs 20,000 or 30% of your salary whichever is less – this lessens the total PAYE deducted from your earnings

- Contributions earn compounded interest – the earlier you start contributing, the more your money grows

- Lastly, pension savings are accessible before the retirement age in the event of job loss or job migration

Think of your finances as a tree. The income you earn is the roots and the lifestyle you lead including bills are the rest of the tree above the soil. If you cut the tree but still have the roots then you can slowly regain your lifestyle over time. If your roots increase in size over time then your tree size also increases. However, should you cut the roots no matter how big the tree is, it will wither; if you are lucky enough and have been saving in your productive years, then your retirement benefits will replace the previous income and you may be able to maintain the same living standards without too much hustle.

The Covid-19 should serve as a wakeup call on why we should save and plan in advance. Just remember Covid-19 is temporary and can change but once you retire there is no going back. During this period, there is a great need for flexibility in terms of retirement savings. One can revise down their contributions or temporarily suspend contributions if they no longer have an income during this period